eCash is led by the development team of Bitcoin ABC, the same team that created Bitcoin Cash in 2017. After three years of shepherding that project, ABC and much of the Bitcoin Cash community fell out of consensus when ABC proposed an infrastructure funding plan, or IFP, whereby 8% of the block reward would go towards funding development and infrastructure. This ultimately led to the Bitcoin Cash chain splitting in two on November 15, 2020. ABC’s newly forked network became the minority fork and was to be temporarily known as Bitcoin Cash ABC, or BCHA.

Then on July 1, 2021, ABC announced their new project would henceforth be known as eCash. They simultaneously launched a brand new website, a new logo, and the new ticker symbol of XEC.

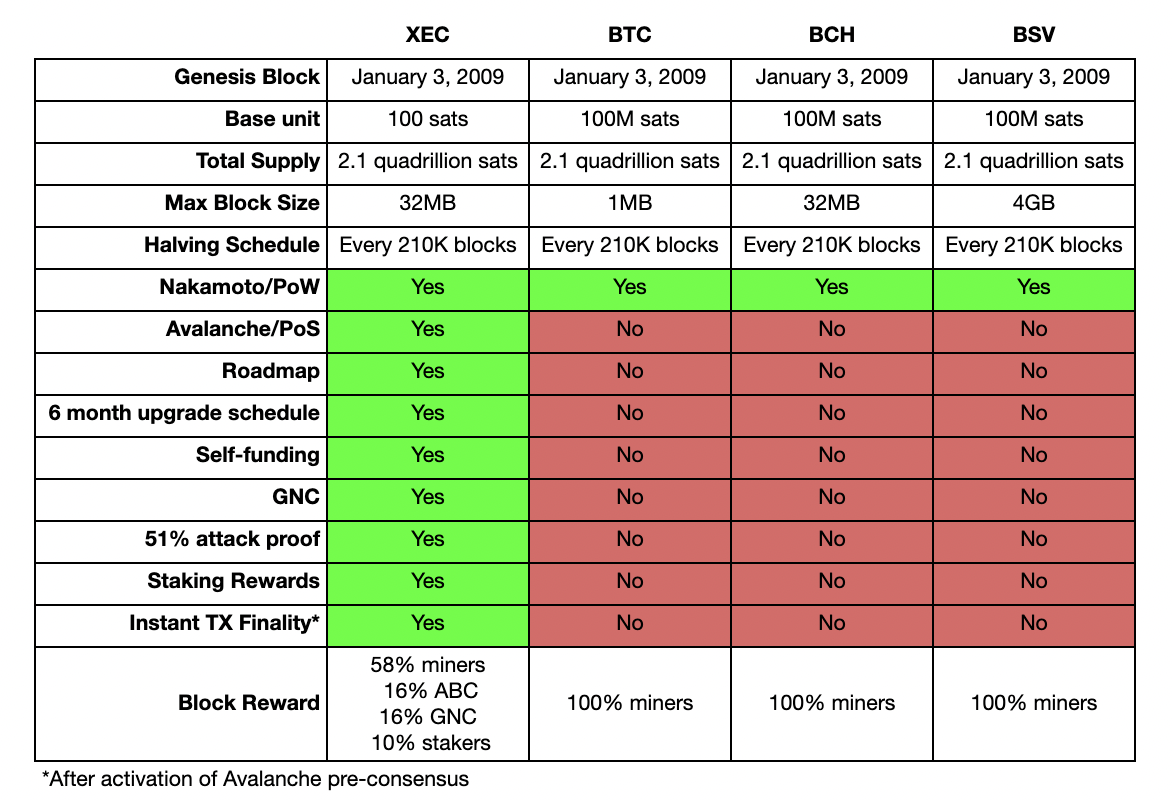

In addition, they also changed the base unit of their new Bitcoin fork from 100M satoshis to 100 satoshis. This means that while 1 BTC, BCH, or BSV is made up or 100M sats, or 0.00000001 BTC/BCH/BSV, 1 XEC is made up of only 100 sats.

As a result, the total supply of eCash is 21T XEC, or a million times the amount of BTC/BCH/BSV. But in actuality the total supply in terms of satoshis is identical for all four networks: 2.1 quadrillion sats.

Currently eCash has the same max block size as Bitcoin Cash at 32MB. This corresponds to a transaction throughput of about 100 transactions per second. However, the stated goal of the eCash project is to achieve 5M transactions per second, or roughly 50 transactions per day for 10B people on the planet.

What sets XEC apart from other Bitcoin forks (here I am speaking only about Bitcoin forks that share the same genesis block mined on January 3, 2009 by Satoshi himself) besides the base unit and the self-funding mechanism is that the eCash chain has added the Avalanche consensus algorithm to complement the Nakamoto consensus algorithm already shared by all Bitcoin forks.

The integration of Avalanche is being done in two phases. The first phase, which was completed in September 2022, is known as Avalanche post-consensus. This makes eCash 51% attack resistant because blocks can’t be reorged once they’ve been mined and validated by Avalanche enabled nodes. The second phase, anticipated to be completed sometime in 2024, is called Avalanche pre-consensus, and will enable instant transaction finality so that 0-confirmation transactions can be safely accepted without having to wait for it to be included in a block.

Adding Avalanche consensus has already resulted in a huge UX improvement as many exchanges have lowered the block confirmation requirements for XEC to only 1. Once Avalanche pre-consensus has been completed, it will mean exchanges will be able to safely accept 0-confirmation eCash transactions without having to worry about 51% attacks or double-spend attacks.

In order to leverage Avalanche, some form of sybil resistance mechanism is required. This is why in addition to the proof of work mining that eCash and all the other Bitcoin forks are famously known for, the eCash network also incorporates a proof of stake component allowing users to stake their eCash and earn a share of the staking rewards.

Staking rewards are going to be launched on November 15, 2023, which coincides with the semi-annual upgrade upgrade schedule eCash has employed since its inception. It has been announced that to run a staking node you will need a minimum of 100M XEC and the staking rewards will comprise 10% of the block reward. In conjunction with this change, the team also announced that the IFP would be increased from 8% to 32% of the total block reward. This was done to help ensure the long-term sustainability of the project since it’s unknown how long this bear market will continue, and due to the block subsidy getting cut in half after the halving expected to occur sometime next April.

Finally, the eCash project also gives large XEC holders the opportunity to join what is known as the global network council, or GNC. A group of proven stakeholders who get to decide on how half of the IFP funds are used. While half of the IFP money goes directly to Bitcoin ABC to fund protocol development, the other half is governed by the GNC members who vote on specific proposals that have requested funding. These can include such things as applications built on top of eCash, community building efforts, or anything else that might increase the value of the eCash ecosystem.

In summary, the eCash project shares many of the same battle-tested properties of Bitcoin and its forks, while also differentiating itself with additional features and UX improvements that those other chains lack. Please see the table below for an overview of what properties eCash shares and doesn’t share with the other chains in the Bitcoin family.

🔥 1 unlock and counting...