The other day, a Twitter troll accused Amaury of having stabbed the Bitcoin Cash community in the back. While I can sort of see how someone might see it that way, I’d also have to assume that person either wasn’t paying attention, has a low IQ, or both.

In order to set the record straight, I will need to start at the beginning, by which I mean the beginning of eCash. You see for me, I see the story of Bitcoin as one thing, and the story of eCash as another, kind of like the old and new testaments in the Bible. And while the story of Bitcoin clearly begins with Satoshi, I think the story of eCash has to begin with Amaury.

I say this because while he’d be the first to admit that he couldn’t have done it alone, I find it hard to believe anyone else could have created eCash without Amaury. And just as it would be fair to say Satoshi is uniquely one of a kind, I believe the same can also be said of the engineer known for being Bitcoin ABC’s benevolent dictator.

For example, from a young age Amaury was already interested in ideas like liberty and anarchy, even being interviewed by the French newspaper Le Monde on the subject long before he was ever associated with Bitcoin. But in addition to his interests in the ideals of freedom, he was also interested in computers from an early age as well:

“I started coding at the age of 9 or 10 on old Thomson MO5 computers in BASIC. These computers were already old at that time, so I was left free to do random stuff with them.”

Combining his interest in libertarian ideas and his love for computers, it isn’t surprising that Amaury came to discover Bitcoin so early:

“My first reaction was skepticism, because there were many previous failed attempts, and the byzantine general problem is provably unsolvable. But Satoshi worked around that limitation by creating a system under which the probability a byzantine failure is not eliminated, but simply becomes exponentially unlikely over time, which is good enough in practice. This was in late 2010.

After this, I kept watching to see if this would pick up. For me, the indication that Bitcoin would become big was the Cyprus crisis in 2012. Many people joined Bitcoin at that time because they realized that banks could not always be relied upon, like in Cyprus. If many people see Bitcoin as an alternative, it means that the meme is catching on.”

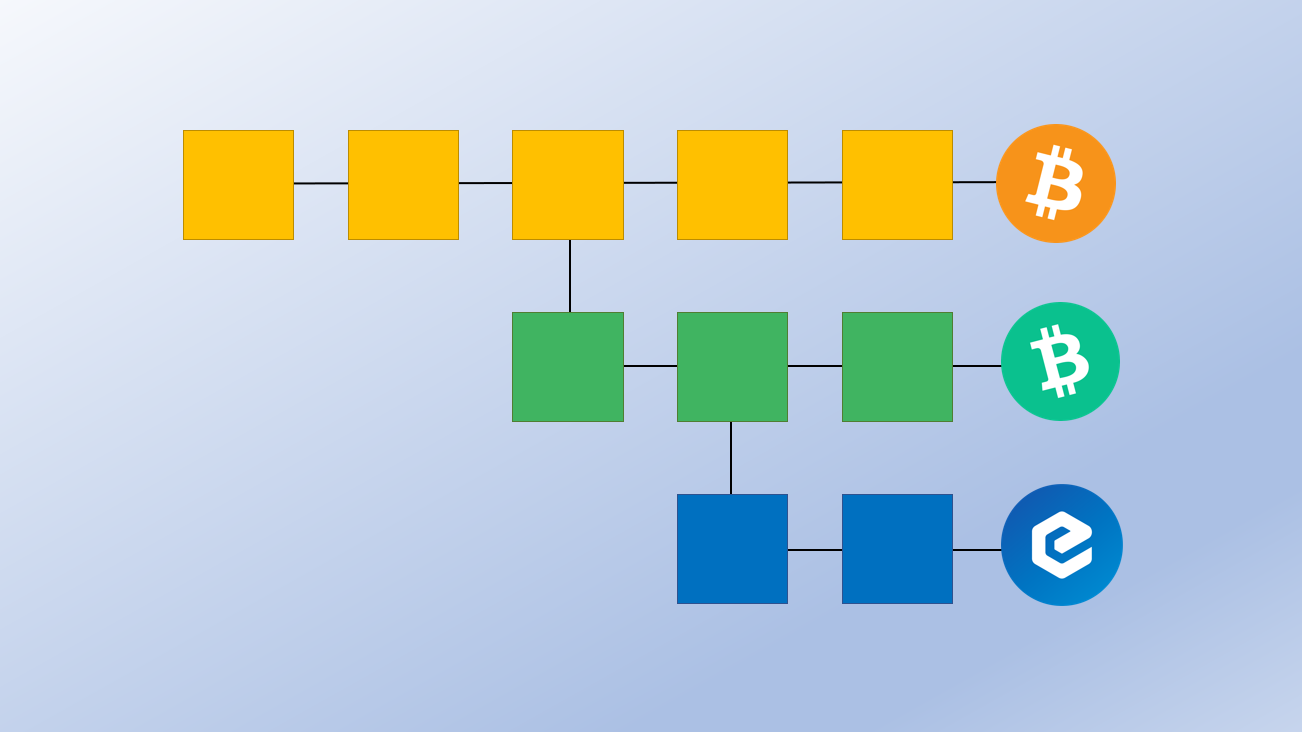

Eventually, Amaury would end up working as a software engineer at Facebook where he learned how to build large scale systems. Meanwhile, he kept an eye on Bitcoin and watched its development from afar. Then came the block size debate, and he decided he could no longer just watch from the sidelines, primarily because the people leading the big block movement seemed to have no idea what they were doing. This is evidenced by the fact that all previous attempts to create a big block version of Bitcoin–Bitcoin Classic, Bitcoin XT, and Bitcoin Unlimited–ended in failure.

Despite making good faith attempts to help the big blocker community, Amaury’s efforts were rejected at every turn, and he was basically dismissed as nothing more than a troublemaker. But not everyone saw him that way. He caught the attention of key industry players like Jihan Wu and Haipo Yang who supported Amaury to take an experimental Bitcoin client he’d been working on privately to serve as the basis for what would eventually become Bitcoin Cash.

It’s around this time that Amaury quits his job at Facebook and begins working on Bitcoin ABC full time. Since Bitcoin Core had already announced SegWit would go live on August 1, 2017–something Amaury was against–he decides to preempt this move by launching Bitcoin Cash on the same day.

For Amaury, the mission was clear, to scale Bitcoin and use the best technology available to make it the best form of digital money ever created. Not long after the fork, Bitcoin ABC releases their official roadmap and technical vision. Unlike previous attempts, the Bitcoin Cash project proved resilient and quickly began to attract various high profile people in the cryptocurrency space. People like Roger Ver of Bitcoin.com, and Ava labs co-founder and CEO Emin Gün Sirer, as well as Vinny Lingham, the founder of the cryptocurrency project known as Civic. There were also those who had previously been associated with the aforementioned Bitcoin XT, Bitcoin Classic, and Bitcoin Unlimited, which made sense since Bitcoin Cash was the only game in town for anyone interested in scaling Bitcoin on-chain.

I could probably write an entire book to describe those first few months of Bitcoin Cash, but all I want to say for now is that even for an outsider like myself, I remember those rumor filled days being full of excitement. It felt like anything was possible, including the idea of one day supplanting BTC as the most valuable cryptocurrency on the planet.

Though that may sound crazy today, it didn’t seem so far-fetched back on November 11, 2017, when BCH saw a massive pump that allowed it to temporarily flip Ethereum to become the second largest cryptocurrency by market cap. Vitalik Buterin himself even congratulated Amaury, Roger and Jihan in this now infamous tweet:

While that #2 ranking didn’t last long, the following month BCH reached a new all time high in dollar terms at $4000 each becoming only the fourth coin to be listed on Coinbase after BTC, ETH, and LTC. The exchange was even forced to halt trading because the price was pumping so hard. As far as I know, something like that has never happened before or since.

But the end of 2017 also marked the end of the bull market for Bitcoin Cash, and while you always hear people in crypto say bear markets are for building, the BCH community would spend this time not on building, but on arguing.

The first signs of trouble appeared when a faction of the BCH community started to believe this Australian guy claiming to be Satoshi was the real deal. The story was that he held over a million bitcoins, and at a certain date, a courier was going to deliver him the private keys to his fortune, and he would sell his massive BTC stake to pump the price of BCH. I was still new to crypto at the time, and I admit wanting nothing more than for this narrative to be true, because who doesn’t want a free ride?

Again, I could probably write an entire book on this part of the eCash story alone, but let’s just say that too much of 2018 was wasted arguing with people who shouldn’t have been taken seriously to begin with. The big technical dispute was over a new transaction ordering rule called CTOR, which would replace Bitcoin’s topological ordering scheme with a canonical one. Amaury was accused of having introduced this new rule out of nowhere and that it would destroy the chain, even though he specifically discussed it in this presentation from back in 2016.

It all came down to the now infamous hash war of November 15, 2018, to determine which direction Bitcoin Cash would take. Would it be the people who supported Amaury and Bitcoin ABC, or those who believed Satoshi was some middle-aged autistic guy from Australia.

Though Bitcoin ABC and their supporters were ultimately victorious, all the uncertainty surrounding the hash war caused the entire cryptocurrency market to crater in the days that followed. Bitcoin’s price fell almost 50% in just over a week, and Ethereum was suddenly in the double digits. As for BCH, it went from a price of over $600 early that November, to $75 only a month later. Imagine dollar cost averaging from $4000 to $600, then having the price crash another 85% after that.

Nuclear Winter had arrived. Though the split with BSV had gotten rid of the cult members, it also resulted in the community shrinking by about half, and the combined market caps of BCH and BSV were nowhere near what the value of BCH had been prior to the split.

Perhaps the biggest problem was that Bitcoin ABC was running out of money. They were already operating on a shoestring budget, but now that the bear market was in full effect, the situation had only gotten worse. The future was no longer full of possibilities, but uncertainty. While it’s true that the Bitcoin Cash ecosystem included other teams besides Bitcoin ABC (e.g. Electron Cash, Bitcoin Unlimited, BCHD, Bitcoin.com, etc.), it was clearly the work of Bitcoin ABC that provided by far the most value to the ecosystem. And yet they were the most poorly funded. Bitcoin.com had the personal wealth of Roger Ver behind it. Bitcoin Unlimited had been gifted 500 BTC back in 2016, which was still worth millions of dollars even after the market downturn. Meanwhile, Bitcoin ABC was left begging for donations. How could Amaury attract and pay for new developers when there was no way to pay them? While some may believe that open source projects should be developed by the work of volunteers, I believe you need people working on a project full time to really achieve anything. It’s the difference between a hobby and a profession.

To try and solve the funding problem, Bitcion.com hosted a fundraiser in the Summer of 2019. A grand total of $300K worth of BCH was raised for Bitcoin ABC. While Roger lauded the success of the fundraiser, considering an experienced software engineer in Silicon Valley can easily cost well over $300K alone, it was obvious that it wasn’t nearly enough to solve anything.

Tensions rose as Amaury and Roger kept butting heads and the Bitcoin Cash community seemed as divided as ever. Roger accused Bitcoin ABC of dragging their feet. Bitcoin ABC accused Roger of lying and expecting them to work for free.

If I were to think of the story of eCash as having the typical three act structure, I’d say the end of act one took place a few months later at the Bitcoin Cash City Conference in September 2019, where Amaury gave his talk on building a better project culture:

Writing about all this brings back so many memories for me. I remember eagerly waiting for the talk to get released on Youtube, because I’d heard from a prominent BCH community member who was in attendance that the talk had been profound. Maybe that skewed my initial impression, but when I finally watched Amaury’s presentation for myself, more than thinking that it was profound, I just felt like everything he said made perfect sense. It made so much sense that I spent the next several hours transcribing the entire thing so more people would have the opportunity to read it.

But as powerful as the talk may have been, Amaury’s words had mostly fallen on deaf ears. Nothing seemed to change. Bitcoin ABC kept trying to ring the alarm bell that they needed funding to survive, but all they got in return was a lot of hatred and accusations of only wanting to line their own pockets. Despite being listed on every major exchange, as well as on prominent platforms like Bitpay and Purse.io, the BCH price was still down 95% from its all time high, with no hope in sight.

If the Bitcoin Cash City Conference marked the end of Act I in this story, the beginning of Act II starts with the publication of a Medium post titled “Infrastructure Funding Plan for Bitcoin Cash”. It was published on January 22, 2020, by Jiang Zhuoer, CEO of the Bitcoin mining pool BTC.top.

The proposal called for 12.5% of the block reward to pay for a development fund that would be in effect for a 6 month trial period. This was, of course, a big deal. Never in the history of Bitcoin had anything less than 100% of the block reward gone to miners. It was a radical change, but it had the potential to provide over $8M in funding based on the BCH price at the time.

The post was signed by Zhuoer, Jihan Wu, Haipo Yang, and Roger Ver. The community didn’t seem to know what to think at first, and as the saying goes, the devil is in the details. Within a few days it became apparent there were too many unanswered questions. All the key opinion leaders did what they always did best, give their opinions. Some were in favor, while some were opposed, but it didn’t take long for many of those originally in favor of the IFP to cave to the mounting pressure of those who were against it. Multiple joint statements were issued. Roger claimed he was tricked into signing the original proposal and that he never wanted to back the IFP in the first place. This despite explaining in the same video that he thought the idea was quite clever since most of the IFP would be funded by BTC miners due to the way Sha256 mining worked.

The IFP was basically dead on arrival. Bitcoin ABC was more or less told if you want to get paid, do your job and maybe someone will sponsor you, but only if you ask nicely. At that point, Amaury and Bitcoin ABC could have just moved on. But even then they refused to give up. They hired a business development manager, they put together a deck outlining their plans with estimates of how many man hours it would take and at what cost. They reached out to exchanges, and mining pools, in an effort to raise the necessary capital, but only managed to come up with about half of what they needed, or roughly $1.5M. Instead of seeing ABC’s efforts as commendable and funding the remaining shortfall, the BCH whales raise an additional $1M of their own and used that money to fund every other team but Bitcoin ABC.

It was only after this that Amaury and his team decided it was time to take matters in their own hands. On August 6, 2020, Amaury announced in a blog post that all blocks mined using the Bitcoin ABC client after the November hardfork must contain an output assigning 8% of the block reward to a specified address. Suddenly everyone who opposed the IFP became this person:

How could Amaury do this? They accused him of abandoning BCH, when in fact it was BCH who had abandoned him. Suddenly it was like everyone had Amaury derangement syndrome. All because he was going to take the client he started, which was open source, and do what he thought was best.

Would you call that back stabbing? The way I see it, Amaury didn’t betray anyone, he just didn’t want to betray himself. He acted in his own self interest by exercising his freedom to do so. But it didn’t come without cost.

I remember hoping more people would see the situation as I did. Going into that November 2020 hardfork, I had no idea how things would play out. I hoped those who had the most skin in the game would choose to follow Amaury and Bitcoin ABC’s leadership, but it didn’t turn out that way. Almost all the miners abandoned ABC, and those who claimed their newly forked Bitcoin Cash ABC (BCHA) coins began rage dumping their BCHA. Someone even created an entire site dedicated to making it more convenient to dump BCHA in exchange for BCH. The BCHA/BCH ratio kept dropping lower and lower, eventually falling to as low as 0.03.

As if that wasn’t bad enough, then came the mining attacks. Someone started attacking the new network by continuously mining empty blocks and orphaning blocks found by honest miners. Someone clearly wanted to see Bitcoin ABC fail, but Bitcoin ABC outsmarted the attacker using a rudimentary version of Avalanche post-consensus, and in the process gave supporters like myself a glimpse of what they were building.

The early days of eCash were nothing like the early days of Bitcoin Cash. Hardly anyone outside of the BCH community was even aware a new Bitcoin fork had been created. On a personal note, it was about a month after the split, towards the end of that December when I came up with the idea for this blog.

Over the next six months, Bitcoin ABC kept working (while I kept writing). With the money left from their last fundraise, they were able to keep the lights on while trying to rebuild all the necessary infrastructure they had lost to those who stayed with BCH. They had to build a new a block explorer, new wallets, not to mention an entirely new brand.

Then on July 1, 2021, six and a half months after parting ways with the project they had started, Bitcoin ABC officially launched e.cash. They announced a new website, a beautiful new logo, the XEC ticker, as well as a redenomination of the base unit from 100 million sats, to 100 sats. Meanwhile, the new coinbase rule continued to funnel half a million XEC to their designated address with each new block that was found.

As with every other cryptocurrency project, there’s no doubt that the eCash project has experienced its fair share of ups and downs. In September of 2021, only a couple of months after the rebrand, XEC reached its all time high of $0.00039 (or $390 for 1M XEC). Though the price has fallen over 90% since then, the difference between this bear market and the one I experienced last cycle has been like night and day. Instead of all that arguing and politicking, what I see instead is a laser focus on building.

They’ve already combined Avalanche and Nakamoto consensus, launched staking rewards, and are on the verge of adding the Chronik indexer directly into the node, but as far as I can tell, we’re still in the middle of Act II in this epic story, or as I like to think of it, the part when eCash grows up. Now the question is when will we start Act III? Only time will tell, of course, but if were a betting man, I would put my money on the activation of Avalanche pre-consensus.

🔥 1 unlock and counting...